Range trading is something that is offered by most decent binary options brokers as a feature to enhance the trading experience for their clients. Alongside touch trading it has become a highly popular way for traders to make profits by correctly predicting the future movement of price. As with regular binary options, range trading are an all-or-nothing options, meaning that they will either expire in the money or out of the money. It can be a particularly useful feature to use within sideways markets and offer a great alternative to regular binary options which are often more effective in trending markets.

Range trading is something that is offered by most decent binary options brokers as a feature to enhance the trading experience for their clients. Alongside touch trading it has become a highly popular way for traders to make profits by correctly predicting the future movement of price. As with regular binary options, range trading are an all-or-nothing options, meaning that they will either expire in the money or out of the money. It can be a particularly useful feature to use within sideways markets and offer a great alternative to regular binary options which are often more effective in trending markets.

Range trading offers fexibility for binary options traders and is an excellent way to enhance profits in all market conditions. Traders have the option to either agree or disagree with price remaining within the predetermined range and therefore this can potentially favour both trending and range-bound markets. The general rule for range trading is the tighter the predetermined range, the more profitable a close in the money will be.

What is range trading?

A simple way to describe range trading is identifying a higher and lower level within which price will remain between for the lifetime of the options that you select. For example, the decision will be if the price will remain within the range of 1.29626 and 1.29725 or if it will leave this range. When you select “in” your option will finish in the money when the price will be in that range for the next 22 minutes. At 11:00 expiration date is reached and when the price never touched the upper or lower boundary it will expire in the money. When it touches one of these boundaries your option will be out of the money. You can also select “out” when you think that the asset price will leave the predefined range. When you think that there’s much volatility going on then this is your type of option as it’s pretty likely that the price will touch the upper or lower boundary when there are some swings going on.

A great broker to trade range options is OptionFair, one of the first brokers that introduced this new trading tool. Click here to start trading with range options at one of the best brokers!

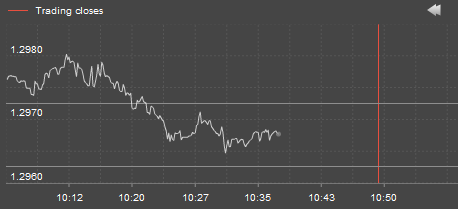

Here’s a chart that makes it very clear:

The two grey horizontal lines represent the upper and lower end, making it a range. Profits tend to be a bit lower with boundary options when you define a bigger range. But there are also so called high yield boundaries where you have a very tight range and when the price stays within this range you can get up to 360% in profits. It’s obvious that it’s not very likely that the price will stay within a range that tight.

Close early feature

A nice feature range options have is that you can exit before the expiration date. So if you buy an “in” option and want to keep the price within a certain range but now news are released that will influence the price you can just sell it real quick and minimize your risk. In this case you will lose some money but you will get a refund. This is not the case when the price leaves the range.